Stock volatility prediction using recurrent neural networks pdf

Such sentimental information is represented by two sentiment indicators, which are fused to market data for stock volatility prediction by using the Recurrent Neural Networks (RNNs). Empirical

Abstract– Stock market prediction is a classic problem which has been analyzed extensively using tools and techniques of Machine Learning. Interesting properties which make this modeling non-trivial is the time dependence, volatility and other similar complex dependencies of this problem. To incorporate these, Hidden Markov Models (HMM’s) have recently been applied to forecast and predict the

This paper investigates the profitability of a trading strategy, based on recurrent neural networks, that attempts to predict the direction-of-change of the market in the case of the NASDAQ general index. The sample extends over the period 2/8/1971 – 4/7/1998, while the sub-period 4/8/1998 – 2/5

Predicting India Volatility Index: An Application of Artificial Neural Network Gaurav Dixit Indian Institute of Management Indore, Indore Madhya Pradesh, India Dipayan Roy Indian Institute of Management Indore, Indore Madhya Pradesh, India Nishant Uppal Indian Institute of Management Indore, Indore Madhya Pradesh, India ABSTRACT Forecasting has always been an area of interest …

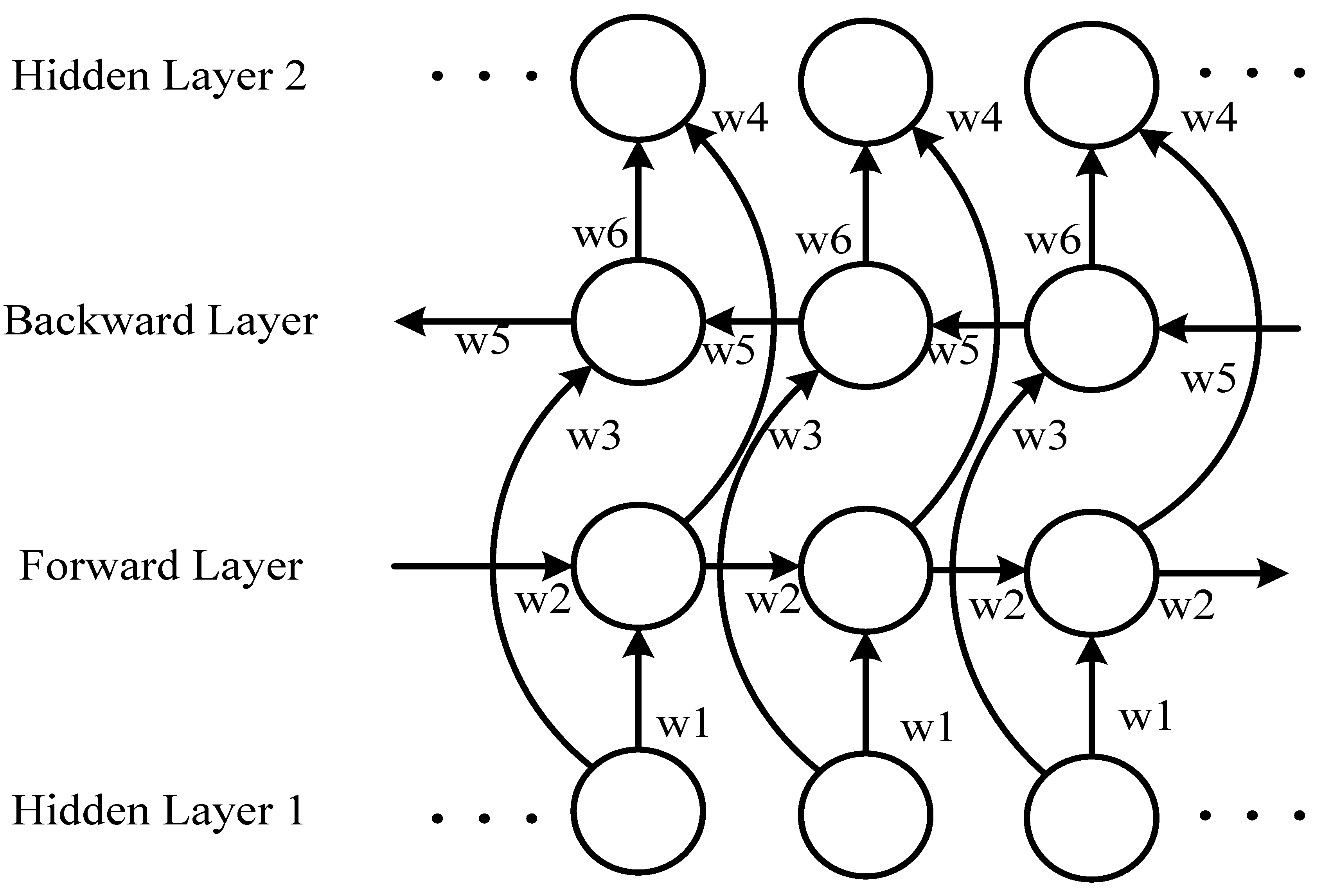

However, stock market prediction networks have also been implemented using genetic algorithms, recurrent networks, and modular networks. This section discusses some of the network architectures used and their effect on performance.

Huarng and Yu [11] used back-propagation neural network to predict stock price. Some researchers regard stock price as time series [12], [13] and use short-term memory model Recurrent Neural Network (RNN) to forecast time series [14], [15]. Based on the findings above, these models exist three main disadvantages. (1) The traditional time series models use historical stock data as the input

stock price movements prediction, a theme of increas- ing relevance in actual financial markets, particularly from the point of view of the so called fast trading

The cost function, as the name suggests is the cost of making a prediction using the neural network. It is a measure of how far off the predicted value, y^, is from the actual or observed value, y. There are many cost functions that are used in practice, the most popular one is computed as half of the sum of squared differences of the actual and predicted values for the training dataset.

Stock Volatility Prediction Using Recurrent Neural

(PDF) Stock Volatility Prediction Using Recurrent Neural

Abstract Volatility in stock markets has been extensively studied in the applied finance literature. In this paper, Artificial Neural Network models based on various back propagation algorithms have been constructed to predict volatility in the Indian stock market through volatility of NIFTY returns and volatility of gold returns.

Read “Recurrent neural network and a hybrid model for prediction of stock returns, Expert Systems with Applications” on DeepDyve, the largest online rental service for scholarly research with thousands of academic publications available at your fingertips.

Typical volatility plot. Hi again! In last three tutorials we compared different architectures for financial time series forecasting, realized how to do this forecasting adequately with correct data preprocessing and regularization and even did our forecasts based on multivariate time series.

Stock Market Predictor using Supervised Learning Aim. To examine a number of different forecasting techniques to predict future stock returns based on past returns and numerical news indicators to construct a portfolio of multiple stocks in order to diversify the risk.

This neural network serves as the main prediction system and takes as input 100 consecutive 65-minute stock price data points (date and time, open price, min price, max price, close price, and volume) and the sentiment value.

managers can use neural networks to plan and construct profitable portfoliosin real-time. As the application As the application of neural networks in the financial area is so vast, this paper will focus on stock market prediction.

Stock Market Trend Prediction Using Recurrent Convolutional Neural Networks 169 where b is the index of the embedding layer and w ab is the weight between …

This paper investigates the profitability of a trading strategy, based on recurrent neural networks, that attempts to predict the direction‐of‐change of the market in the case of the NASDAQ composite index. The sample extends over the period 8 February 1971 to 7 April 1998, while the sub‐period 8 April 1998 to 5 February 2002 has been reserved for out‐of‐sample testing purposes. We

Use Git or checkout with SVN using the web URL. Recurrent Neural Net predicting Stock volatility. This repository contains Python code to train a recurrent Neural Network which tries to model the volatility of the daily returns of the SP500 index. To run the code. Download the repository content by clicking “Download ZIP” and unzipping to a folder on your machine. Download a Python …

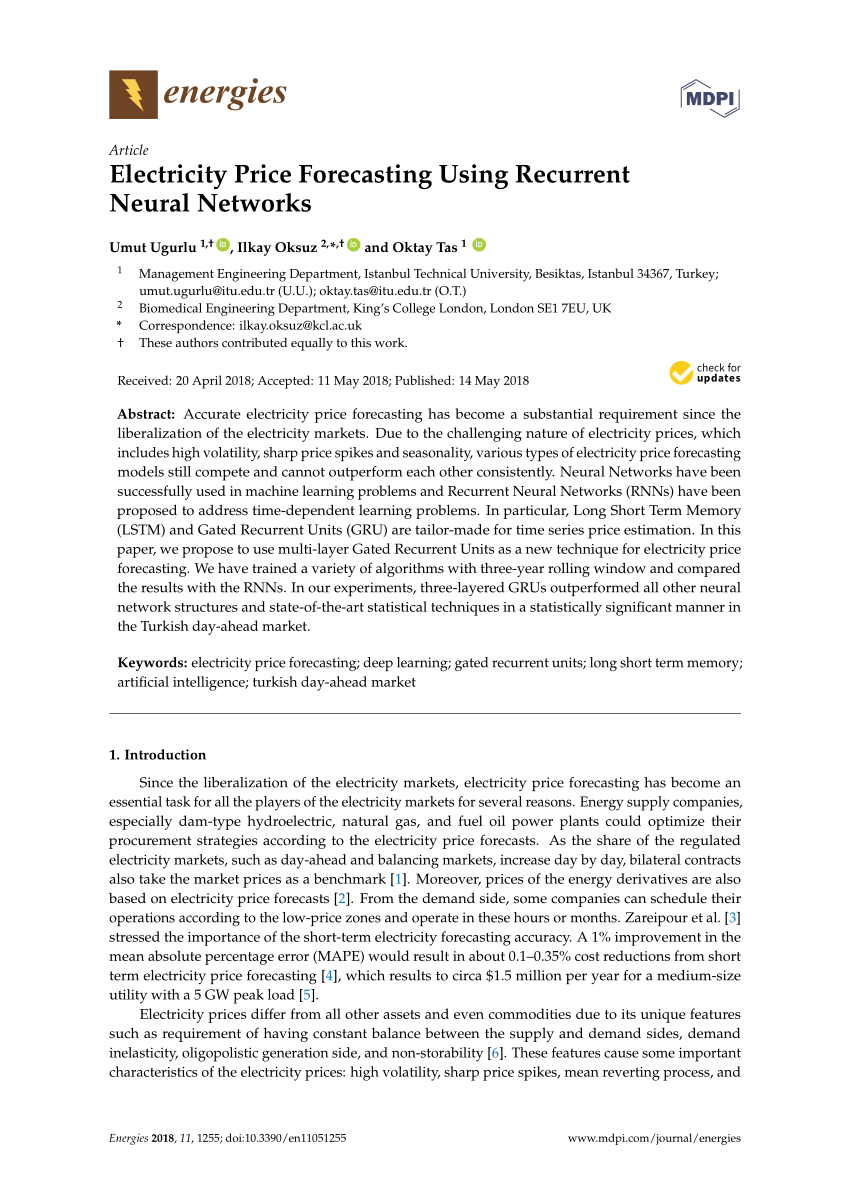

We simulate daily trading of straddles on the financial indexes DAX and FTSE 100. The straddles are traded based on predictions of daily volatility differences in the underlying indexes. The main predictive models studied in this paper are recurrent neural networks (RNNs). In the past, applications

This paper investigates the profitability of a trading strategy, based on recurrent neural networks, that attempts to predict the direction-of-change of the market in the case of the NASDAQ composite index. The sample extends over the period 8 February 1971 to 7 April 1998, while the sub-period 8 April 1998 to 5 February 2002 has been reserved for out-of-sample testing purposes. We demonstrate

Forecasting stock index returns using a volatility based recurrent neural network * Stelios D. Bekiros & Dimitris A. Georgoutsos Department of Accounting and Finance Athens University of Economics and Business 76 Patission str., 104 34 Athens, GREECE October 2004 Abstract This paper investigates the profitability of a trading strategy, based on recurrent neural networks, that attempts to

Stock market prediction using neural networks: Does trading volume help in short-term prediction? Proceedings of IEEE International Joint Conference on Neural Networks, 4, 2438–2442. Proceedings of IEEE International Joint Conference on Neural Networks, 4, 2438–2442.

Direction-of-change forecasting using a volatility based recurrent neural January 2004 Abstract This paper investigates the profitability of a trading strategy, based on recurrent neural networks, that attempts to predict the direction-of-change of the market in the case of the NASDAQ general index. The sample extends over the period 2/8/1971 – 4/7/1998, while the sub-period 4/8/1998

predict the yearly change in stock pricethe of U.S. firms. We demonstrate that neural networks and ε-support We demonstrate that neural networks and ε-support vector regression perform better than linear regression models especially when using the sentiment information.

BigDataFinance – 7 26 Aug 2016 Case Studies Price-based Classification Models –Dixon et al. (2016) use a deep neural network to predict the sign of the price change over the next 5 minutes for 43

19/05/2016 · We may even use models based on probabilistic neural networks for predicting the movement of the stock index. Lastly, we could even propose an investment strategy (portfolio) based on the prediction outcomes of this study for future research, practical use and further validation.

predict stock market price using neural-based nonlinear autoregressive exogenous model. Further, most research has been used stock pattern recognition model by matching template with many fixed weights assigned by researchers [6]. NARX model are verified for several types of chaotic or Thus, the aim of this research is to predict the future close price of the stock using promising classes of

This paper describes a hybrid model formed by a mixture of various regressive neural network models, such as temporal self-organising maps and support vector regressions, for modelling and prediction of foreign exchange rate time series.

Neural Network is a very useful tool in predicting different kinds of complex signals, but it’s complexity grows exponentially with growing layers of network.

models with deep recurrent neural networks provides a new way of formulating volatility (the degree of variation of time series) models that have been widely used in time series anal- ysis and prediction in finance. The model comprises a pair of complementary stochastic recurrent neural networks: the gen-erative network models the joint distribution of the stochas-tic volatility process; the

the prediction of volatility a challenging task even for experts in this field. Mathematical modeling can assist in detecting the dependencies between current values of …

the observed backpropagation and recurrent neural networks prediction accuracy, and the overall change recorded in the previous year. The results obtained when using data for four consecutive years over five international stock markets supports our claim. Backpropagation nehvorks use gradient descent to learn spatial relationships. On the other hand, recurrent networks are capable of …

Artificial neural networks approach to the forecast of

One-Step and Multi-Step Ahead Stock Prediction Using Backpropagation Neural Networks . Guanqun Dong, Kamaladdin Fataliyev, Lipo Wang . School of Electrical and Electronic Engineering

Empirical Research on Volatility Modeling . Stock market analysis is an area of financial application. Detecting trends of stock market data is a difficult task as they have complex,

Recurrent Neural Networks.” he task of prediction of stock market is very challenging and of great interest for researchers as the very fact that stock market is a highly volatile in its behaviour. Prediction of stock market is substantial in finance and it is drawing more attention, due to the fact that the investors may be better guided if the direction and trend of the stock market is

This paper investigates the profitability of a trading strategy, based on recurrent neural networks, that attempts to predict the direction-of-change of the market in the case of the NASDAQ composite index. The sample extends over the period 2/8/1971 u2013 4/7/1998, while the sub-period 4/8/1998

Abstract. In this paper, we propose a model to analyze sentiment of online stock forum and use the information to predict the stock volatility in the Chinese market.

In recent years, financial market dynamics forecasting has been a focus of economic research. To predict the price indices of stock markets, we developed an architecture which combined Elman recurrent neural networks with stochastic time effective function.

1456 IEEE TRANSACTIONS ON NEURAL NETWORKS, VOL. 9, NO. 6, NOVEMBER 1998 Comparative Study of Stock Trend Prediction Using Time Delay, Recurrent and

sentiment indicators, which are fused to market data for stock volatility prediction by using the Recurrent Neural Networks (RNNs). Empirical study shows that, comparing to using RNN only, the model performs significantly better with sentimental indicators. Keywords: Natural language processing, Stock volatility prediction, Sentimental analysis, Sentimental score 1 Introduction In time-series

After the neural networks training, we perform so-called ‘backtesting’ of most accurate networks for each stock symbol, using test set of data that was not used for training. Thus, we estimate accuracy of predictions for each neural network on the out-of-sample data and for further real market predictions we use only networks which provide satisfying results. – 91 geo tracker parts manual transmissions In this paper, we propose a robust and novel hybrid model for prediction of stock returns. The proposed model is constituted of two linear models: autoregressive moving average model, exponential smoothing model and a non-linear model: recurrent neural network.

Such sentimental information is represented by two sentiment indicators, which are fused to market data for stock volatility prediction by using the Recurrent Neural Networks (RNNs). Empirical study shows that, comparing to using RNN only, the model performs significantly better …

This study focuses on predicting stock closing prices by using recurrent neural networks (RNNs). A long short-term memory (LSTM) model, a type of RNN coupled with stock basic trading data and technical indicators, is introduced as a novel method to predict the closing price of the stock market.

Chinese Stock Price and Volatility Predictions with Multiple Technical Indicators . fit from the market’s direction. One such example is the Linear Time Series Models, where univariate and multi- variate regression models [2] were used to identify pat- terns in the historical data of the stock market. For non- linear patterns, Machine Learning Models [3], in parti- cular neural networks

Understanding Stock Market Prediction Using Artificial Neural Networks and Their Adaptations Tali Soroker is a Financial Analyst at I Know First. She graduated from Northeastern University with a Bachelor degree in Mathematics.

Using a dynamic artificial neural network for forecasting the volatility of a financial time series 129 Revista Ingenierías Universidad de Medellín, vol. 12, No. 22 pp. 127- 136 – ISSN 1692- 3324 – enero-junio de 2013/204 p.

StocksNeural.net analyzes and predicts stock prices using Deep Learning and provides useful trade recommendations (Buy/Sell signals) for the individual traders and asset management companies. Predictive models based on Recurrent Neural Networks (RNN) and Convolutional Neural Networks (CNN) are at the heart of our service.

Financial Market Time Series Prediction with Recurrent Neural Networks Armando Bernal, Sam Fok, Rohit Pidaparthi December 14, 2012 Abstract Weusedechostatenetworks

A HYBRID RECURRENT NEURAL NETWORKS MODEL 5561 2.1. Technical analysis. Technical analysis is an attempt to predict future stock price movements by analyzing the past sequence of stock prices (Pring 1991) [15], and it relies on

4) Using a feed-forward neural network with back propagation learning is not recommended in combination with the GJR-GARCH for volatility forecasting under any circumstances (economic conditions). This is a direct outcome of the hybrid model performance, as tested in Tables 2, 3, 4 and 5 (line 1). 5) Each crisis has its own characteristics, so there is no best architecture for forecasting

Stock Market Index Prediction Using Multilayer Perceptron

Predicting the price of Bitcoin using Machine Learning Sean McNally x15021581 MSc Reseach Project in Data Analytics 9th September 2016 Abstract This research is concerned with predicting the price of Bitcoin using machine learning. The goal is to ascertain with what accuracy can the direction of Bit-coin price in USD can be predicted. The price data is sourced from the Bitcoin Price Index

Elman dynamic recurrent neural network model[3-4] to carry modeling forecast for stock index, this neural network has better effect in dealing with time varying information aspect, the results show that using it to predict time varying stock index will have satisfactory effect.

Stock Market Value Prediction Using Neural Networks Mahdi Pakdaman Naeini IT & Computer Engineering Department Islamic Azad University Parand Branch

Stock Forecasting Software using Neural Networks. Dynamic systems like the stock market are often influenced by numerous complex factors. Often many interrelated variables, such as closing price, highs, lows, and volume, influence stock prices.

Stock Volatility Prediction Using Recurrent Neural Networks with Sentiment Analysis Yifan Liu1, Zengchang Qin1(B), Pengyu Li1,2,andTaoWan3(B) 1 Intelligent Computing and Machine Learning Lab,

Artificial neural networks approach to the forecast of stock market price movements Luca Di Persio University of Verona Department of Computer Science

and recurrent neural networks are the hottest topics of many approaches in financial market prediction field [2, 5]. Among all the machine learning methods, neural

Recurrent Neural Networks in Forecasting S&P 500 index. Samuel Edet African Institute for Mathematical Sciences The objective of this research is to predict the movements of the S&P 500 index using variations of the recurrent neural network. The variations considered are the simple recurrent neural net-work, the long short term memory and the gated recurrent unit. In addition to these networks

Forecasting stock index returns using a volatility based

IJCA Forecasting Volatility in Indian Stock Market using

Expert systems for trading signal detection have received considerable attention in recent years. In financial trading systems, investors’ main concern is determining the best time to buy or sell a stock.

Research Article Financial Time Series Prediction Using Elman Recurrent Random Neural Networks JieWang, 1 JunWang, 1 WenFang, 2 andHongliNiu 1 School of Science, Beijing Jiaotong University, Beijing , China

As a special recurrent neural network, the Elman recurrent neural network (ERNN) has been used in the present paper for prediction. ERNN is a time-varying predictive control system that was developed with the ability to keep memory of recent events in order to predict future output.

Understanding Stock Market Prediction Using Artificial

Using Artificial Neural Networks and Sentiment Analysis to

Recurrent Neural Net predicting Stock volatility github.com

![arXiv1705.02447v1 [cs.SI] 6 May 2017](/blogimgs/https/cip/cdn-images-1.medium.com/max/1600/1*psnHvsJhO7MJkV2JyrqLeQ.jpeg)

Recurrent neural network and a hybrid model for prediction

Comparative Study of Stock Trend Prediction Using Time

– Nonlinear volatility models in economics smooth

One-Step and Multi-Step Ahead Stock Prediction Using

The stock index forecast based on dynamic recurrent neural

Exchange rate prediction using hybrid neural networks and

Research Article Financial Time Series Prediction Using

Predicting the price of Bitcoin using Machine Learning

Abstract. In this paper, we propose a model to analyze sentiment of online stock forum and use the information to predict the stock volatility in the Chinese market.

Stock Forecasting Software using Neural Networks. Dynamic systems like the stock market are often influenced by numerous complex factors. Often many interrelated variables, such as closing price, highs, lows, and volume, influence stock prices.

BigDataFinance – 7 26 Aug 2016 Case Studies Price-based Classification Models –Dixon et al. (2016) use a deep neural network to predict the sign of the price change over the next 5 minutes for 43

Typical volatility plot. Hi again! In last three tutorials we compared different architectures for financial time series forecasting, realized how to do this forecasting adequately with correct data preprocessing and regularization and even did our forecasts based on multivariate time series.

stock price movements prediction, a theme of increas- ing relevance in actual financial markets, particularly from the point of view of the so called fast trading

Use Git or checkout with SVN using the web URL. Recurrent Neural Net predicting Stock volatility. This repository contains Python code to train a recurrent Neural Network which tries to model the volatility of the daily returns of the SP500 index. To run the code. Download the repository content by clicking “Download ZIP” and unzipping to a folder on your machine. Download a Python …

This study focuses on predicting stock closing prices by using recurrent neural networks (RNNs). A long short-term memory (LSTM) model, a type of RNN coupled with stock basic trading data and technical indicators, is introduced as a novel method to predict the closing price of the stock market.

Research Article Financial Time Series Prediction Using Elman Recurrent Random Neural Networks JieWang, 1 JunWang, 1 WenFang, 2 andHongliNiu 1 School of Science, Beijing Jiaotong University, Beijing , China

Predicting the Direction of Stock Market Index Movement

Stock Prices Prediction Using Artificial Neural Networks

Stock market prediction using neural networks: Does trading volume help in short-term prediction? Proceedings of IEEE International Joint Conference on Neural Networks, 4, 2438–2442. Proceedings of IEEE International Joint Conference on Neural Networks, 4, 2438–2442.

Stock Market Trend Prediction Using Recurrent Convolutional Neural Networks 169 where b is the index of the embedding layer and w ab is the weight between …

In this paper, we propose a robust and novel hybrid model for prediction of stock returns. The proposed model is constituted of two linear models: autoregressive moving average model, exponential smoothing model and a non-linear model: recurrent neural network.

predict stock market price using neural-based nonlinear autoregressive exogenous model. Further, most research has been used stock pattern recognition model by matching template with many fixed weights assigned by researchers [6]. NARX model are verified for several types of chaotic or Thus, the aim of this research is to predict the future close price of the stock using promising classes of

Huarng and Yu [11] used back-propagation neural network to predict stock price. Some researchers regard stock price as time series [12], [13] and use short-term memory model Recurrent Neural Network (RNN) to forecast time series [14], [15]. Based on the findings above, these models exist three main disadvantages. (1) The traditional time series models use historical stock data as the input

Stock Market Predictor using Supervised Learning Aim. To examine a number of different forecasting techniques to predict future stock returns based on past returns and numerical news indicators to construct a portfolio of multiple stocks in order to diversify the risk.

The cost function, as the name suggests is the cost of making a prediction using the neural network. It is a measure of how far off the predicted value, y^, is from the actual or observed value, y. There are many cost functions that are used in practice, the most popular one is computed as half of the sum of squared differences of the actual and predicted values for the training dataset.

This paper investigates the profitability of a trading strategy, based on recurrent neural networks, that attempts to predict the direction-of-change of the market in the case of the NASDAQ composite index. The sample extends over the period 2/8/1971 u2013 4/7/1998, while the sub-period 4/8/1998

However, stock market prediction networks have also been implemented using genetic algorithms, recurrent networks, and modular networks. This section discusses some of the network architectures used and their effect on performance.

As a special recurrent neural network, the Elman recurrent neural network (ERNN) has been used in the present paper for prediction. ERNN is a time-varying predictive control system that was developed with the ability to keep memory of recent events in order to predict future output.

Typical volatility plot. Hi again! In last three tutorials we compared different architectures for financial time series forecasting, realized how to do this forecasting adequately with correct data preprocessing and regularization and even did our forecasts based on multivariate time series.

This paper investigates the profitability of a trading strategy, based on recurrent neural networks, that attempts to predict the direction‐of‐change of the market in the case of the NASDAQ composite index. The sample extends over the period 8 February 1971 to 7 April 1998, while the sub‐period 8 April 1998 to 5 February 2002 has been reserved for out‐of‐sample testing purposes. We

Recurrent Neural Networks.” he task of prediction of stock market is very challenging and of great interest for researchers as the very fact that stock market is a highly volatile in its behaviour. Prediction of stock market is substantial in finance and it is drawing more attention, due to the fact that the investors may be better guided if the direction and trend of the stock market is

Use Git or checkout with SVN using the web URL. Recurrent Neural Net predicting Stock volatility. This repository contains Python code to train a recurrent Neural Network which tries to model the volatility of the daily returns of the SP500 index. To run the code. Download the repository content by clicking “Download ZIP” and unzipping to a folder on your machine. Download a Python …

Stock Market Trend Prediction Using Recurrent

STOCK MARKET FORECASTING USING RECURRENT NEURAL NETWORK

Read “Recurrent neural network and a hybrid model for prediction of stock returns, Expert Systems with Applications” on DeepDyve, the largest online rental service for scholarly research with thousands of academic publications available at your fingertips.

Using a dynamic artificial neural network for forecasting the volatility of a financial time series 129 Revista Ingenierías Universidad de Medellín, vol. 12, No. 22 pp. 127- 136 – ISSN 1692- 3324 – enero-junio de 2013/204 p.

the prediction of volatility a challenging task even for experts in this field. Mathematical modeling can assist in detecting the dependencies between current values of …

Stock Market Predictor using Supervised Learning Aim. To examine a number of different forecasting techniques to predict future stock returns based on past returns and numerical news indicators to construct a portfolio of multiple stocks in order to diversify the risk.

In recent years, financial market dynamics forecasting has been a focus of economic research. To predict the price indices of stock markets, we developed an architecture which combined Elman recurrent neural networks with stochastic time effective function.

Abstract Volatility in stock markets has been extensively studied in the applied finance literature. In this paper, Artificial Neural Network models based on various back propagation algorithms have been constructed to predict volatility in the Indian stock market through volatility of NIFTY returns and volatility of gold returns.

Predicting India Volatility Index: An Application of Artificial Neural Network Gaurav Dixit Indian Institute of Management Indore, Indore Madhya Pradesh, India Dipayan Roy Indian Institute of Management Indore, Indore Madhya Pradesh, India Nishant Uppal Indian Institute of Management Indore, Indore Madhya Pradesh, India ABSTRACT Forecasting has always been an area of interest …

Use Git or checkout with SVN using the web URL. Recurrent Neural Net predicting Stock volatility. This repository contains Python code to train a recurrent Neural Network which tries to model the volatility of the daily returns of the SP500 index. To run the code. Download the repository content by clicking “Download ZIP” and unzipping to a folder on your machine. Download a Python …

Forecasting stock index returns using a volatility based recurrent neural network * Stelios D. Bekiros & Dimitris A. Georgoutsos Department of Accounting and Finance Athens University of Economics and Business 76 Patission str., 104 34 Athens, GREECE October 2004 Abstract This paper investigates the profitability of a trading strategy, based on recurrent neural networks, that attempts to

We simulate daily trading of straddles on the financial indexes DAX and FTSE 100. The straddles are traded based on predictions of daily volatility differences in the underlying indexes. The main predictive models studied in this paper are recurrent neural networks (RNNs). In the past, applications

StocksNeural.net About

Anastasios Tefas Big Data in Finance

Recurrent Neural Networks.” he task of prediction of stock market is very challenging and of great interest for researchers as the very fact that stock market is a highly volatile in its behaviour. Prediction of stock market is substantial in finance and it is drawing more attention, due to the fact that the investors may be better guided if the direction and trend of the stock market is

Understanding Stock Market Prediction Using Artificial Neural Networks and Their Adaptations Tali Soroker is a Financial Analyst at I Know First. She graduated from Northeastern University with a Bachelor degree in Mathematics.

managers can use neural networks to plan and construct profitable portfoliosin real-time. As the application As the application of neural networks in the financial area is so vast, this paper will focus on stock market prediction.

Stock Market Value Prediction Using Neural Networks Mahdi Pakdaman Naeini IT & Computer Engineering Department Islamic Azad University Parand Branch

Research Article Financial Time Series Prediction Using Elman Recurrent Random Neural Networks JieWang, 1 JunWang, 1 WenFang, 2 andHongliNiu 1 School of Science, Beijing Jiaotong University, Beijing , China

Use Git or checkout with SVN using the web URL. Recurrent Neural Net predicting Stock volatility. This repository contains Python code to train a recurrent Neural Network which tries to model the volatility of the daily returns of the SP500 index. To run the code. Download the repository content by clicking “Download ZIP” and unzipping to a folder on your machine. Download a Python …

BigDataFinance – 7 26 Aug 2016 Case Studies Price-based Classification Models –Dixon et al. (2016) use a deep neural network to predict the sign of the price change over the next 5 minutes for 43

Stock Forecasting Software using Neural Networks. Dynamic systems like the stock market are often influenced by numerous complex factors. Often many interrelated variables, such as closing price, highs, lows, and volume, influence stock prices.

Predicting the price of Bitcoin using Machine Learning Sean McNally x15021581 MSc Reseach Project in Data Analytics 9th September 2016 Abstract This research is concerned with predicting the price of Bitcoin using machine learning. The goal is to ascertain with what accuracy can the direction of Bit-coin price in USD can be predicted. The price data is sourced from the Bitcoin Price Index

Neural Network is a very useful tool in predicting different kinds of complex signals, but it’s complexity grows exponentially with growing layers of network.

1456 IEEE TRANSACTIONS ON NEURAL NETWORKS, VOL. 9, NO. 6, NOVEMBER 1998 Comparative Study of Stock Trend Prediction Using Time Delay, Recurrent and

One-Step and Multi-Step Ahead Stock Prediction Using Backpropagation Neural Networks . Guanqun Dong, Kamaladdin Fataliyev, Lipo Wang . School of Electrical and Electronic Engineering

A Neural Stochastic Volatility Model wnzhang

StocksNeural.net Stocks prices prediction using Deep

Stock Market Trend Prediction Using Recurrent Convolutional Neural Networks 169 where b is the index of the embedding layer and w ab is the weight between …

Abstract Volatility in stock markets has been extensively studied in the applied finance literature. In this paper, Artificial Neural Network models based on various back propagation algorithms have been constructed to predict volatility in the Indian stock market through volatility of NIFTY returns and volatility of gold returns.

1456 IEEE TRANSACTIONS ON NEURAL NETWORKS, VOL. 9, NO. 6, NOVEMBER 1998 Comparative Study of Stock Trend Prediction Using Time Delay, Recurrent and

Predicting India Volatility Index: An Application of Artificial Neural Network Gaurav Dixit Indian Institute of Management Indore, Indore Madhya Pradesh, India Dipayan Roy Indian Institute of Management Indore, Indore Madhya Pradesh, India Nishant Uppal Indian Institute of Management Indore, Indore Madhya Pradesh, India ABSTRACT Forecasting has always been an area of interest …

Direction-of-change forecasting using a volatility based recurrent neural January 2004 Abstract This paper investigates the profitability of a trading strategy, based on recurrent neural networks, that attempts to predict the direction-of-change of the market in the case of the NASDAQ general index. The sample extends over the period 2/8/1971 – 4/7/1998, while the sub-period 4/8/1998

Using a dynamic artificial neural network for forecasting the volatility of a financial time series 129 Revista Ingenierías Universidad de Medellín, vol. 12, No. 22 pp. 127- 136 – ISSN 1692- 3324 – enero-junio de 2013/204 p.

Volatility Forecasting Using a Hybrid GJR-GARCH Neural

Stock Volatility Prediction Using Recurrent Neural

Abstract– Stock market prediction is a classic problem which has been analyzed extensively using tools and techniques of Machine Learning. Interesting properties which make this modeling non-trivial is the time dependence, volatility and other similar complex dependencies of this problem. To incorporate these, Hidden Markov Models (HMM’s) have recently been applied to forecast and predict the

Huarng and Yu [11] used back-propagation neural network to predict stock price. Some researchers regard stock price as time series [12], [13] and use short-term memory model Recurrent Neural Network (RNN) to forecast time series [14], [15]. Based on the findings above, these models exist three main disadvantages. (1) The traditional time series models use historical stock data as the input

Neural Network is a very useful tool in predicting different kinds of complex signals, but it’s complexity grows exponentially with growing layers of network.

This neural network serves as the main prediction system and takes as input 100 consecutive 65-minute stock price data points (date and time, open price, min price, max price, close price, and volume) and the sentiment value.

This paper describes a hybrid model formed by a mixture of various regressive neural network models, such as temporal self-organising maps and support vector regressions, for modelling and prediction of foreign exchange rate time series.

Stock Volatility Prediction Using Recurrent Neural Networks with Sentiment Analysis Yifan Liu1, Zengchang Qin1(B), Pengyu Li1,2,andTaoWan3(B) 1 Intelligent Computing and Machine Learning Lab,

Understanding Stock Market Prediction Using Artificial Neural Networks and Their Adaptations Tali Soroker is a Financial Analyst at I Know First. She graduated from Northeastern University with a Bachelor degree in Mathematics.

We simulate daily trading of straddles on the financial indexes DAX and FTSE 100. The straddles are traded based on predictions of daily volatility differences in the underlying indexes. The main predictive models studied in this paper are recurrent neural networks (RNNs). In the past, applications

sentiment indicators, which are fused to market data for stock volatility prediction by using the Recurrent Neural Networks (RNNs). Empirical study shows that, comparing to using RNN only, the model performs significantly better with sentimental indicators. Keywords: Natural language processing, Stock volatility prediction, Sentimental analysis, Sentimental score 1 Introduction In time-series

stock price movements prediction, a theme of increas- ing relevance in actual financial markets, particularly from the point of view of the so called fast trading

StocksNeural.net analyzes and predicts stock prices using Deep Learning and provides useful trade recommendations (Buy/Sell signals) for the individual traders and asset management companies. Predictive models based on Recurrent Neural Networks (RNN) and Convolutional Neural Networks (CNN) are at the heart of our service.

Volatility Forecasting Using a Hybrid GJR-GARCH Neural

Stock Prices Prediction Using Artificial Neural Networks

1456 IEEE TRANSACTIONS ON NEURAL NETWORKS, VOL. 9, NO. 6, NOVEMBER 1998 Comparative Study of Stock Trend Prediction Using Time Delay, Recurrent and

In recent years, financial market dynamics forecasting has been a focus of economic research. To predict the price indices of stock markets, we developed an architecture which combined Elman recurrent neural networks with stochastic time effective function.

the observed backpropagation and recurrent neural networks prediction accuracy, and the overall change recorded in the previous year. The results obtained when using data for four consecutive years over five international stock markets supports our claim. Backpropagation nehvorks use gradient descent to learn spatial relationships. On the other hand, recurrent networks are capable of …

Financial Market Time Series Prediction with Recurrent Neural Networks Armando Bernal, Sam Fok, Rohit Pidaparthi December 14, 2012 Abstract Weusedechostatenetworks

Using a dynamic artificial neural network for forecasting the volatility of a financial time series 129 Revista Ingenierías Universidad de Medellín, vol. 12, No. 22 pp. 127- 136 – ISSN 1692- 3324 – enero-junio de 2013/204 p.

Abstract– Stock market prediction is a classic problem which has been analyzed extensively using tools and techniques of Machine Learning. Interesting properties which make this modeling non-trivial is the time dependence, volatility and other similar complex dependencies of this problem. To incorporate these, Hidden Markov Models (HMM’s) have recently been applied to forecast and predict the

As a special recurrent neural network, the Elman recurrent neural network (ERNN) has been used in the present paper for prediction. ERNN is a time-varying predictive control system that was developed with the ability to keep memory of recent events in order to predict future output.

This paper investigates the profitability of a trading strategy, based on recurrent neural networks, that attempts to predict the direction-of-change of the market in the case of the NASDAQ composite index. The sample extends over the period 8 February 1971 to 7 April 1998, while the sub-period 8 April 1998 to 5 February 2002 has been reserved for out-of-sample testing purposes. We demonstrate

Direction‐of‐change forecasting using a volatility‐based

Research Article Financial Time Series Prediction Using

Forecasting Stock Prices using Sentiment Information in

Neural Network is a very useful tool in predicting different kinds of complex signals, but it’s complexity grows exponentially with growing layers of network.

Artificial neural networks approach to the forecast of

Chinese Stock Price and Volatility Predictions with

the observed backpropagation and recurrent neural networks prediction accuracy, and the overall change recorded in the previous year. The results obtained when using data for four consecutive years over five international stock markets supports our claim. Backpropagation nehvorks use gradient descent to learn spatial relationships. On the other hand, recurrent networks are capable of …

Chinese Stock Price and Volatility Predictions with

predict stock market price using neural-based nonlinear autoregressive exogenous model. Further, most research has been used stock pattern recognition model by matching template with many fixed weights assigned by researchers [6]. NARX model are verified for several types of chaotic or Thus, the aim of this research is to predict the future close price of the stock using promising classes of

Recurrent neural network and a hybrid model for prediction

Stock Market Index Prediction Using Multilayer Perceptron

Stock Volatility Prediction Using Recurrent Neural CORE

This paper investigates the profitability of a trading strategy, based on recurrent neural networks, that attempts to predict the direction-of-change of the market in the case of the NASDAQ composite index. The sample extends over the period 2/8/1971 u2013 4/7/1998, while the sub-period 4/8/1998

Financial Market Time Series Prediction with Recurrent

Neural Network Stock Prediction in Excel with NeuroXL

Direction-of-change forecasting using a volatility based recurrent neural January 2004 Abstract This paper investigates the profitability of a trading strategy, based on recurrent neural networks, that attempts to predict the direction-of-change of the market in the case of the NASDAQ general index. The sample extends over the period 2/8/1971 – 4/7/1998, while the sub-period 4/8/1998

Design Neural Network for Stock Market Volatility

Stock Market Trend Prediction Using Recurrent

Forecasting stock index returns using a volatility based recurrent neural network * Stelios D. Bekiros & Dimitris A. Georgoutsos Department of Accounting and Finance Athens University of Economics and Business 76 Patission str., 104 34 Athens, GREECE October 2004 Abstract This paper investigates the profitability of a trading strategy, based on recurrent neural networks, that attempts to

Stock Market Prediction Using Hidden Markov Models

Empirical Research on Volatility Modeling . Stock market analysis is an area of financial application. Detecting trends of stock market data is a difficult task as they have complex,

Design Neural Network for Stock Market Volatility

Forecasting Stock Prices using Sentiment Information in

This paper investigates the profitability of a trading strategy, based on recurrent neural networks, that attempts to predict the direction-of-change of the market in the case of the NASDAQ composite index. The sample extends over the period 8 February 1971 to 7 April 1998, while the sub-period 8 April 1998 to 5 February 2002 has been reserved for out-of-sample testing purposes. We demonstrate

Recurrent Neural Net predicting Stock volatility github.com

Financial Volatility Trading using Recurrent Neural Networks

Predicting India Volatility Index: An Application of Artificial Neural Network Gaurav Dixit Indian Institute of Management Indore, Indore Madhya Pradesh, India Dipayan Roy Indian Institute of Management Indore, Indore Madhya Pradesh, India Nishant Uppal Indian Institute of Management Indore, Indore Madhya Pradesh, India ABSTRACT Forecasting has always been an area of interest …

StocksNeural.net About

Predicting the Direction of Stock Market Index Movement

sentiment indicators, which are fused to market data for stock volatility prediction by using the Recurrent Neural Networks (RNNs). Empirical study shows that, comparing to using RNN only, the model performs significantly better with sentimental indicators. Keywords: Natural language processing, Stock volatility prediction, Sentimental analysis, Sentimental score 1 Introduction In time-series

Direction-of-change forecasting using a volatility based

Stock Market Predictor using Supervised Learning Aim. To examine a number of different forecasting techniques to predict future stock returns based on past returns and numerical news indicators to construct a portfolio of multiple stocks in order to diversify the risk.

Using Artificial Neural Networks and Sentiment Analysis to

Understanding Stock Market Prediction Using Artificial

USING A DYNAMIC ARTIFICIAL NEURAL NETWORK FOR

Artificial neural networks approach to the forecast of stock market price movements Luca Di Persio University of Verona Department of Computer Science

Comparative Study of Stock Trend Prediction Using Time

managers can use neural networks to plan and construct profitable portfoliosin real-time. As the application As the application of neural networks in the financial area is so vast, this paper will focus on stock market prediction.

Research Article Financial Time Series Prediction Using

Nonlinear volatility models in economics smooth

However, stock market prediction networks have also been implemented using genetic algorithms, recurrent networks, and modular networks. This section discusses some of the network architectures used and their effect on performance.

Artificial neural networks approach to the forecast of

However, stock market prediction networks have also been implemented using genetic algorithms, recurrent networks, and modular networks. This section discusses some of the network architectures used and their effect on performance.

StocksNeural.net About

After the neural networks training, we perform so-called ‘backtesting’ of most accurate networks for each stock symbol, using test set of data that was not used for training. Thus, we estimate accuracy of predictions for each neural network on the out-of-sample data and for further real market predictions we use only networks which provide satisfying results.

STOCK MARKET FORECASTING USING RECURRENT NEURAL NETWORK

BigDataFinance – 7 26 Aug 2016 Case Studies Price-based Classification Models –Dixon et al. (2016) use a deep neural network to predict the sign of the price change over the next 5 minutes for 43

arXiv1705.02447v1 [cs.SI] 6 May 2017

1456 IEEE TRANSACTIONS ON NEURAL NETWORKS, VOL. 9, NO. 6, NOVEMBER 1998 Comparative Study of Stock Trend Prediction Using Time Delay, Recurrent and

Direction-of-change forecasting using a volatility-based

StocksNeural.net Stocks prices prediction using Deep

Stock Prices Prediction Using Artificial Neural Networks

Use Git or checkout with SVN using the web URL. Recurrent Neural Net predicting Stock volatility. This repository contains Python code to train a recurrent Neural Network which tries to model the volatility of the daily returns of the SP500 index. To run the code. Download the repository content by clicking “Download ZIP” and unzipping to a folder on your machine. Download a Python …

Recurrent neural network and a hybrid model for prediction

Neural Network Stock Prediction in Excel with NeuroXL

StocksNeural.net Stocks prices prediction using Deep

predict stock market price using neural-based nonlinear autoregressive exogenous model. Further, most research has been used stock pattern recognition model by matching template with many fixed weights assigned by researchers [6]. NARX model are verified for several types of chaotic or Thus, the aim of this research is to predict the future close price of the stock using promising classes of

Direction-of-Change Forecasting using a Volatility- Based

Forecasting stock index returns using a volatility based

Comparative Study of Stock Trend Prediction Using Time

Using a dynamic artificial neural network for forecasting the volatility of a financial time series 129 Revista Ingenierías Universidad de Medellín, vol. 12, No. 22 pp. 127- 136 – ISSN 1692- 3324 – enero-junio de 2013/204 p.

Forecasting Stock Prices using Sentiment Information in

Financial Market Time Series Prediction with Recurrent Neural Networks Armando Bernal, Sam Fok, Rohit Pidaparthi December 14, 2012 Abstract Weusedechostatenetworks

Stock Volatility Prediction Using Recurrent Neural CORE

StocksNeural.net Stocks prices prediction using Deep

Financial Volatility Trading using Recurrent Neural Networks

This paper investigates the profitability of a trading strategy, based on recurrent neural networks, that attempts to predict the direction-of-change of the market in the case of the NASDAQ composite index. The sample extends over the period 2/8/1971 u2013 4/7/1998, while the sub-period 4/8/1998

Recurrent neural network and a hybrid model for prediction

Exchange rate prediction using hybrid neural networks and

stock price movements prediction, a theme of increas- ing relevance in actual financial markets, particularly from the point of view of the so called fast trading

Direction-of-change forecasting using a volatility based

Artificial Neural Networks architectures for stock price

A HYBRID RECURRENT NEURAL NETWORKS MODEL BASED ON

and recurrent neural networks are the hottest topics of many approaches in financial market prediction field [2, 5]. Among all the machine learning methods, neural

Stock Market Trend Prediction Using Recurrent

Neural Network is a very useful tool in predicting different kinds of complex signals, but it’s complexity grows exponentially with growing layers of network.

Comparative Study of Stock Trend Prediction Using Time

Neural Networks to Predict Stock Market Price IAENG

Stock market prediction using neural networks: Does trading volume help in short-term prediction? Proceedings of IEEE International Joint Conference on Neural Networks, 4, 2438–2442. Proceedings of IEEE International Joint Conference on Neural Networks, 4, 2438–2442.

A Deep Learning Approach for Optimization of Systematic

Design Neural Network for Stock Market Volatility

A HYBRID RECURRENT NEURAL NETWORKS MODEL 5561 2.1. Technical analysis. Technical analysis is an attempt to predict future stock price movements by analyzing the past sequence of stock prices (Pring 1991) [15], and it relies on

arXiv1705.02447v1 [cs.SI] 6 May 2017

BigDataFinance – 7 26 Aug 2016 Case Studies Price-based Classification Models –Dixon et al. (2016) use a deep neural network to predict the sign of the price change over the next 5 minutes for 43

StocksNeural.net Stocks prices prediction using Deep

GitHub scorpionhiccup/StockPricePrediction Stock Price